Business

How to Check the Status of Your GST Registration Application

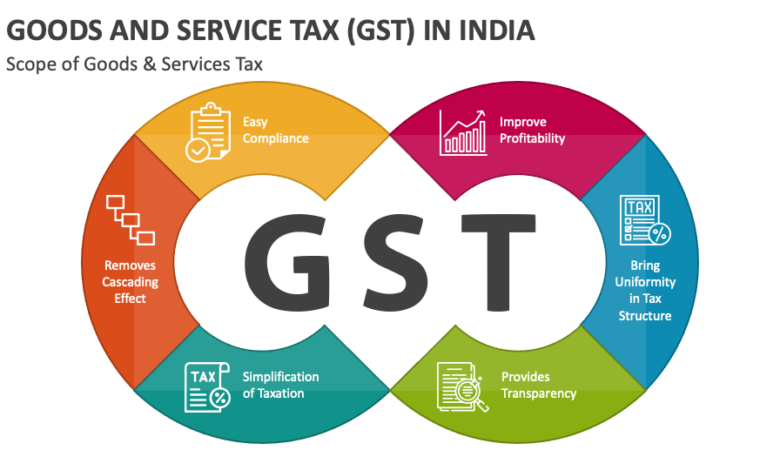

Registering for the Goods and Services Tax (GST) in India is a major step for businesses and individuals. It not only ensures compliance with tax regulations but also provides access to various benefits under the GST regime. However, once you’ve completed the online GST registration process, you may wonder about the status of your application. Let’s see how to check the status of the GST registration application.

The GST Registration Process

GST registration online is essential for businesses and individuals involved in the supply of goods or services. Here are the steps involved:

- Determine Your Eligibility: The first step is to confirm whether you meet the eligibility criteria for GST registration. Businesses with an annual turnover exceeding a specific threshold, as defined by the government, are required to register for GST.

- Collect Required Documents: You must gather and organise the necessary documents and information, including your business’s Permanent Account Number (PAN), proof of business ownership, and bank account details.

- Online Application: You can complete the GST registration application online through the official GST portal. Provide accurate information, upload the required documents, and complete the application process.

- Verification: After submitting your application, it undergoes a verification process. It includes a thorough examination of the documents and information provided.

- GSTIN Allotment: Upon successful verification, you will receive a unique Goods and Services Tax Identification Number (GSTIN). This number is crucial for all your GST-related activities.

- Provisional Certificate: You will be issued a provisional registration certificate, which is valid for six months. This certificate allows you to commence business operations while your application is processed.

- Final Approval: The final approval process includes physically verifying your business premises. An authorised GST officer may visit your place of business to ensure compliance with GST regulations.

- GST Registration Certificate: Once the verification is complete and your application is approved, you will receive your GST registration certificate. This certificate signifies that your business is now a legal entity registered under the GST regime.

The Significance of Checking Application Status

Now that you have completed the GST registration process, you may be wondering why it’s essential to monitor the status of your application. There are several reasons why staying informed about your application status is crucial: - Timely Compliance: By checking the status of your application, you can ensure that your business complies with tax regulations. This is particularly important for businesses that must start collecting and remitting GST.

- Transparency: Monitoring your application status offers transparency in the registration process. It allows you to track the progress and anticipate the time it takes for your application to be approved.

- Proactive Measures: If your application faces any issues or delays, knowing the status lets you take proactive measures to resolve them. It could include addressing any discrepancies or providing additional information as requested.

Checking GST Application Status Online

The most convenient and efficient way to check your GST application status is online. Here’s how you can do it: - Visit the Official GST Portal: To get started, visit the official GST portal (https://www.gst.gov.in/).

- Navigate to the Services Section: On the homepage, navigate to the “Services” tab. You will find a drop-down menu. Select “Registration” from the options.

- Click on ‘Track Application Status’: Under the “Registration” section, you will see the option to “Track Application Status.” Click on it.

- Enter Your ARN: You will be prompted to enter your Application Reference Number (ARN) provided during your application submission. Once you’ve entered the ARN, click on “SEARCH.”

- View Your Status: The portal will display the status of your application. You can see whether it is “Approved,” “Pending,” “Rejected,” or “Migrated.”

Helpful Tips for a Smooth GST Registration

While tracking your application status is vital, ensuring a smooth GST registration process from the beginning is equally important. Here are some tips for a successful registration:

- Accurate Documentation: Double-check that all your documents and information are accurate and current before submitting your application.

- Complete Application: Ensure you’ve filled out every application section correctly and attached all required documents.

- Stay Informed: Keep yourself informed about GST regulations and updates, as they can impact your registration process.

Conclusion

Checking the status of your GST registration online application is a crucial part of the process. It ensures timely compliance, transparency, and the ability to take proactive measures if needed.

By following the tips provided, you can increase your chances of a smooth GST registration experience and enjoy the benefits of GST registration for your business or as an individual taxpayer.